nevada vs california income taxes

Also the list of common. 100 US Average.

Nevada Vs California Taxes Retirepedia

View a comparison chart of California vs.

. In Nevada the state tax rate is 18 and the state sales tax is 9. For more information about the income tax in these states visit the. Use this tool to compare the state income taxes in California and Nevada or any other pair of states.

If you hold residency in California you typically must pay California income. The most significant taxes you pay in Nevada. Below 100 means cheaper than the US average.

The cost of Nevada vs California formation is almost the same. Above 100 means more expensive. Since the cost of living is much higher California has taxes on almost everything.

This tool compares the tax brackets for single individuals in each state. I think it is important to note the rates in the states as well. This tool compares the tax brackets for single individuals in each state.

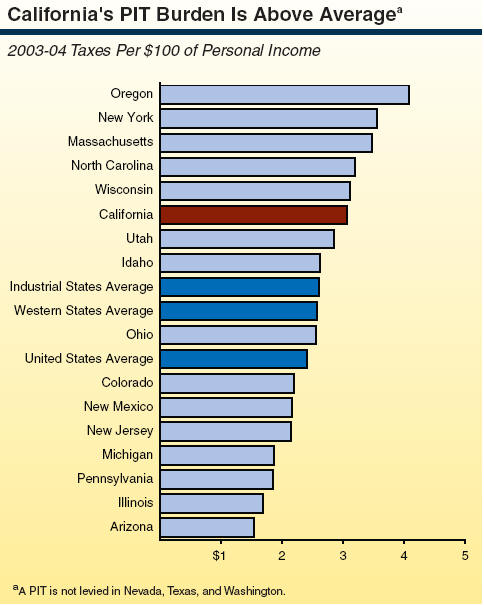

Taxpayers in Nevada get to enjoy one of the most tax-friendly situations in the nation. With a top marginal income tax rate of 123 percent Nevada vs California taxes are known for having the highest state income tax bracket in the country. Nevada on the other hand is known to tax less.

For income taxes in all fifty states see the income. 37 for incomes over 578125 693750 for married couples filing jointly 35 for incomes over 231250 462500 for. Interestingly the neighboring state of Nevada is ranked number one.

Tax brackets for income earned in 2023. This rate however does. Taxes on a 1000000 is approximately 6000.

Owing to this a Nevada LLC is able to leverage this structure by having limited tax liabilities. In California the state income tax is 10 and. Use this tool to compare the state income taxes in Nevada and California or any other pair of states.

Whether youre a doctor teacher real estate agent or entertainer. Nevada provides an extensive gaming culture that generates a lot of tax income for the state. For more information about the income tax in these states visit the Arizona and Nevada income sales tax nevada vs california tax pages.

The state of California requires residents to pay personal income taxes but Nevada does not. The state of California ranks 40th in corporate tax rankings according to the Tax Foundation. Creating an LLC in California the state filing fee is 70 whereas in Nevada its 75.

Taxes in Los Angeles California are 863 more expensive than Las Vegas Nevada. Property Tax In Nevada vs. Incorporating in Nevada instead of California may provide you with tax savings and other corporate protection benefits.

Payroll Tax Calculator For Employers Gusto

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Top 10 Inbound Vs Top 10 Outbound Us States In 2021 How Do They Compare On A Variety Of Economic Tax Business Climate And Political Measures American Enterprise Institute Aei

California Retirement Tax Friendliness Smartasset

Unaffordable California It Doesn T Have To Be This Way

Nevada Vs California Taxes Explained Retirebetternow Com

How Many Electoral College Votes Does Each U S State Have Britannica

General Sales Taxes And Gross Receipts Taxes Urban Institute

Individual Income Taxes Urban Institute

Nevada Income Tax Calculator Smartasset

Wisconsin Land Of Badgers And No State Income Tax By Patrick Mccorkle Medium

Property Taxes In Nevada Guinn Center For Policy Priorities

California S Tax System A Primer

States With The Highest Lowest Tax Rates

Retire In California Or Nevada Retirebetternow Com

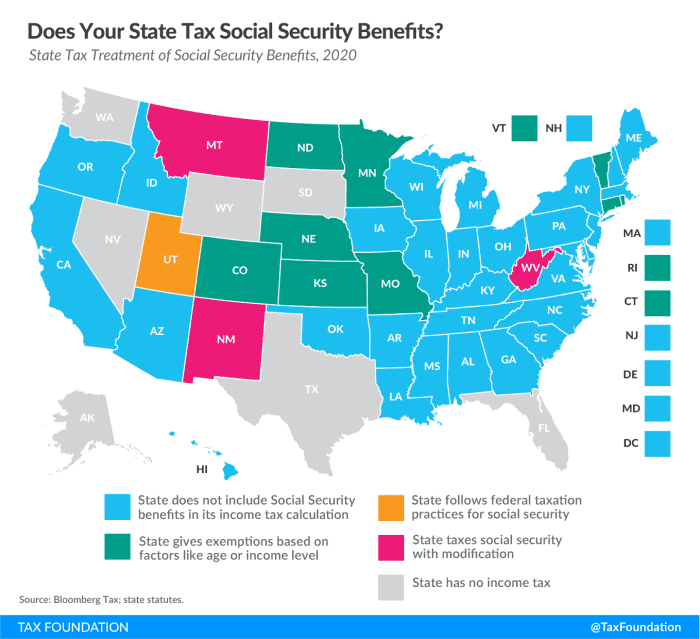

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute